The lockdowns of 2020 may possibly have prompted people to put more funds towards their surroundings, boosting earnings for house enhancement shops Lowe’s (NYSE:Reduced) and House Depot (NYSE:High definition), but the financial and housing availability crunches of 2022 are trying to keep them there.

Home furnishings, electronics and dwelling business established-ups aimed at producing dwelling a better area to are living and do the job fueled 2020 acquiring, but with shoppers going through climbing costs of gas and food, theyre going to dwelling enhancement outlets to deal with repairs themselves and commence gardens. This is holding development at Lowe’s and House Depot sturdy, creating them both equally most likely successful portfolio additions this summer months, in my belief.

Both solutions have growing dividend yields, earning them interesting for price traders hunting to make passive revenue as effectively. Just before you add possibly of these residence advancement shares to your portfolio, however, there are some disadvantages to take into consideration.

Lowes

Lowes (NYSE:Lower) is a dwelling enhancement retail chain running in the U.S., Canada and Mexico. It gives solutions for design, upkeep, repairs and reworking. The housing market place might be cooling a very little from the highs of 2021, which may well encourage tasks in the dwelling youre in.

Revenues for the business have doubled about the earlier 10 years, and earnings for each share are expected to grow about 13%. Lowe’s has a dividend yield of 1.66%, and the business has a very long keep track of record of mounting dividends. That could support sweeten the deal for buyers.

Analysts rate Lowe’s a invest in, even though bulls think the firm faces risks from soaring desire prices, supply chain troubles and flattening housing price ranges. Its worth noting that the median age of houses in the U.S. is 39 years, an age when residences will will need an expanding quantity of routine maintenance and could be candidates for transforming.

Lowe’s will get a GF Score of 96, driven principally by leading scores for profiability and progress.

House Depot

Surpassing forecasts in 9 of the final 10 quarters, one more major U.S. household enhancement retailer, Residence Depot (NYSE:High definition), not long ago reported 10.7% growth in web revenue calendar year-about-year.

Property Depot counts skilled contractors between its biggest customers, and their huge-ticket buys were being up 18% throughout the past 12 months. EPS has developed 17% above the past 3 many years and income is up 8% around the previous year, getting it a acquire ranking from analysts.

Dwelling Depot has a dividend generate of 2.26%, generating it the extra attractive of these two shares for these in look for of dividends.

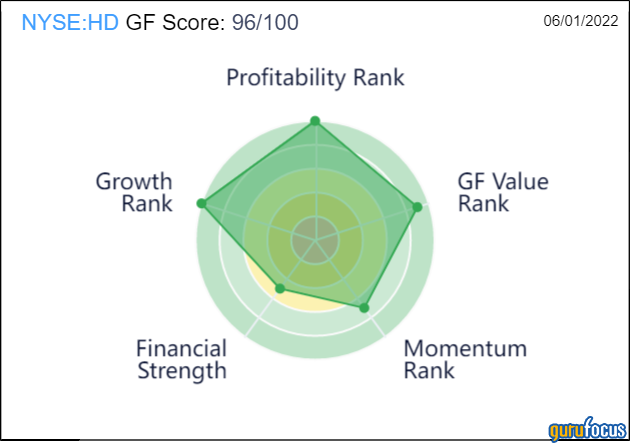

Like Lowe’s, Dwelling Depot also has a GF Rating of of 96/100. In addition to large development and profitability, it scores greater than Lowe’s for GF Benefit, even though it loses details for weaker momentum.

This write-up to start with appeared on GuruFocus.

More Stories

What To Look For In A Home Improvement Contractor

Car Buying Tips: Why Does It Make Sense to Buy a Discontinued Car Model?

Can You Build a House Out of Plastic Lumber?